Cambridge, a city synonymous with academic excellence, historical charm, and a thriving tech scene, naturally holds immense appeal for property buyers and investors. But venturing into the Cambridge property market can feel like entering a world veiled in secrecy, particularly when it comes to property valuation in Cambridge. Fear not, intrepid homeowner or seasoned investor! This guide serves as your decoder ring, demystifying the key factors that influence property valuations in this dynamic city.

The Valuation Equation: A Symphony of Factors

In contrast to a straightforward price, a property’s worth in Cambridge is a complex melody made up of numerous, concrete and intangible components. To successfully navigate the market, it is imperative to comprehend these elements:

- Location, Location, Location: In Cambridge, this age-old proverb is accurate. Value is greatly impacted by proximity to prominent research institutes like the Babraham Institute, premier universities like Cambridge and Anglia Ruskin, and bustling cultural centres like the Corn Exchange. those tucked away in quaint old neighbourhoods like the Backs or in busy business districts like Mill Road are invariably more expensive than those in more remote locations.

- Property Type and Size: Naturally, a separate home with a large garden will fetch a higher price than a cosy studio apartment. The quantity of bathrooms and bedrooms is also quite important. Family houses in highly sought-after school catchment regions, such as Chesterton or Trumpington, are in high demand and appreciate in value.

- Condition and Amenities: A property in good condition with contemporary fixtures and appliances—such as energy-efficient ones—will be worth more than one that requires remodelling. Desired extras like a balcony, a private garden, or secure parking can also raise the value considerably.

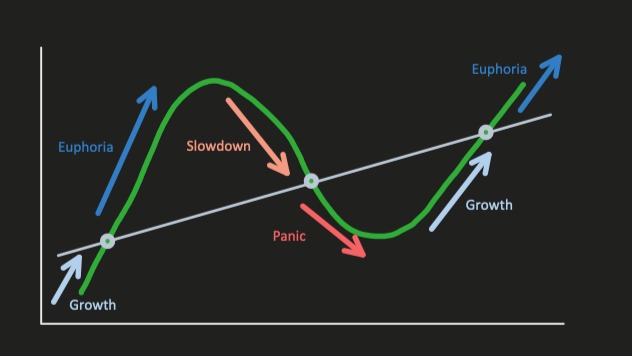

- Market Trends:The Cambridge property market’s general state has a big impact on appraisals. It is essential to comprehend current trends, such as those related to supply and demand, interest rates, and economic projections. High demand in a growing market might drive up valuations; a downturn in the economy could cause them to stagnate or even fall.

Beyond the Tangible: Unveiling the Intangibles

Although the aforementioned elements serve as the foundation for a Cambridge property assessment, there are other, less obvious criteria to take into account as well:

- Architectural Significance: Historical properties might fetch a premium, such as those created by famous architects or listed buildings. They draw customers who are prepared to shell out more for a rare architectural jewel or a piece of history.

- Conservation Areas: There may be limitations on renovations or adjustments for properties located within conservation areas that have been declared. This may reduce the amount of customisation possibilities available, but it also guarantees the area’s character will be preserved, which could increase value for buyers who respect the area’s historical charm.

- Leasehold vs. Freehold: Freehold properties, in which you own both the building and the land, can command a higher value than leasehold properties, in which you just own the building. Value is also influenced by how long the lease is left, with shorter leases having renewal costs that may have an effect on the total appraisal.

Tools for Demystification: Your Valuation Arsenal

Now that you are aware of the major variables, let’s examine various methods and resources to learn more about Cambridge property valuation:

- Online Valuation Tools: Free or paid appraisals based on an algorithm that takes into account variables including size, location, and property type are provided by a number of internet resources. These can be a good place to start, but proceed with care since they might not be as accurate as a professional appraisal that considers the particulars of your property and the neighbourhood market.

- Sold Property Prices: Examine recent prices paid for comparable properties in the neighbourhood of your choice. You may filter properties based on sale date, property type, and location on websites such as Rightmove or Zoopla. This offers useful information that can be used to estimate the current market worth of properties that are similar.

- Professional Valuation Reports:Seeking a professional valuation report from a Chartered Surveyor (RICS) experienced in the Cambridge property market might yield a more precise and thorough evaluation. To produce a trustworthy assessment, this study will take into account all pertinent variables, including a thorough examination of the property and current market trends.

Seeking Expert Guidance: Decoding the Market with Estate Agents

In order to successfully negotiate the complexity of Cambridge property values, estate agents can be very helpful allies. This is how they can help you:

- Local Market Expertise: Credible property agents are well-versed in the Cambridge property market, including buyer preferences, microlocation subtleties, and current trends. This information enables them to offer insightful commentary and customise their recommendations to your unique situation.

- Comparative Market Analysis (CMA): An extensive analysis called a CMA, which compares your property to comparable previously sold properties in the neighbourhood, can be obtained from estate agents. Based on comparable homes and the state of the market, this aids in determining a reasonable asking price.

- Negotiation Skills: When selling or purchasing a property, estate agents with strong negotiating abilities can help you get the greatest price for your property.