In Malaysia’s vibrant trading landscape, success isn’t solely determined by market analysis and economic indicators. It’s about delving into the depths of human psychology and understanding how emotions shape trading decisions.

Trading in Malaysia’s financial markets can be a thrilling yet challenging endeavour. Whether you’re dabbling in stocks or forex CFDs in Malaysia, success often hinges not only on market knowledge but also on mastering the intricate workings of the human mind.

The Influence of Emotions

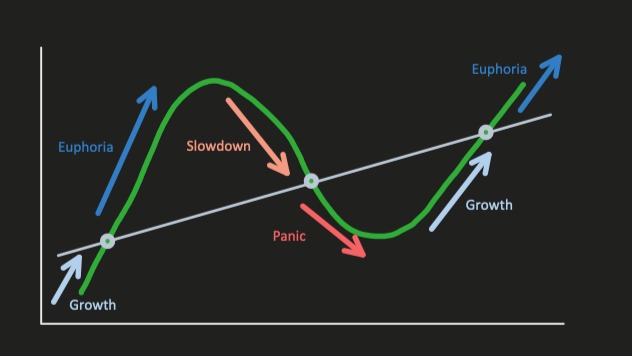

Emotions play a pivotal role in traders’ decision-making process in Malaysia. Fear, greed, excitement, and even overconfidence can cloud judgement and lead to impulsive actions. Picture this: You see a stock skyrocketing, and FOMO (fear of missing out) kicks in. Without proper analysis, you jump in, only to witness a sudden reversal, leaving you in panic.

Emotional rollercoasters are commonplace in the trading landscape. When traders let emotions take the wheel, rational decision-making takes a backseat. Fear may prompt premature exits, while greed may fuel reckless trades. Recognising these emotional triggers is the first step toward regaining control over one’s trading strategy.

Keeping Emotions in Check

Successful traders in Malaysia understand the importance of emotional regulation. They know how to keep their cool when the market gets volatile. Instead of reacting impulsively to every price fluctuation, they rely on a well-thought-out trading plan. They accept losses as part of the game and don’t let emotions dictate their next move.

Maintaining emotional stability requires a combination of self-awareness and discipline. Traders must learn to recognise their emotional triggers and develop coping mechanisms to mitigate their impact. This could involve taking a step back, reassessing the situation, or seeking advice from a mentor or fellow trader.

The Power of Patience

In a fast-paced market like Malaysia’s, patience is indeed a virtue. Successful traders don’t rush into trades simply for the sake of being active. They wait for the opportune moment, conducting thorough research and analysis before making decisions. This disciplined approach helps them avoid unnecessary risks and maximise their chances of success.

Patience isn’t just about waiting for the right trade; it’s also about staying resilient during inevitable periods of adversity. Markets fluctuate, and not every trade will be a winner. By staying patient and sticking to their strategy, traders can ride out temporary setbacks and position themselves for long-term success.

Navigating the World of Forex CFDs in Malaysia

In the diverse landscape of financial instruments, forex CFDs (Contract for Differences) stand out as a popular choice among traders in Malaysia. Offering exposure to the foreign exchange market without the need for ownership of the underlying assets, these contracts provide ample opportunities for profit.

They allow traders to speculate on the price movements of currency pairs, such as USD/MYR or EUR/USD, without actually owning the currencies. Instead, traders enter into a contract with a broker to exchange the difference in the value of the currency pair between the opening and closing of the trade. This allows for potential profits from both rising and falling markets.

Risk Management

When it comes to trading forex CFDs in Malaysia, risk management is non-negotiable. It’s about preserving capital and staying in the game for the long haul. Successful traders allocate only a tiny portion of their capital to each trade, ensuring that no single loss can wipe out their accounts. They set stop-loss orders to limit potential losses and adhere to strict risk-reward ratios.

Effective risk management isn’t just about minimising losses; it’s also about maximising profits while protecting downside risk. Traders must strike a balance between capital preservation and capital growth, taking calculated risks based on their risk tolerance and market conditions.

Discipline: The Backbone of Success

Discipline separates the amateurs from the pros in the sphere of trading. Successful traders stick to their trading plan religiously, even when the temptation to deviate arises. They avoid emotional trading by setting predefined entry and exit points based on objective criteria. This unwavering discipline helps them stay focused on their long-term goals and overcome short-term setbacks.

Discipline extends beyond the trading desk; it encompasses every aspect of a trader’s life. From maintaining a healthy lifestyle to managing personal finances, discipline breeds success in all endeavours. Traders can build the foundation for a prosperous and fulfilling life by cultivating discipline in and out of the markets.

Practical Tips for Maintaining a Healthy Trading Mindset

Keep Emotions in Check: Practise mindfulness techniques such as deep breathing or visualisation to stay calm and composed during volatile market conditions.

Stick to Your Plan: Create a well-defined trading strategy with precise entry and exit rules, and stick to it regardless of market fluctuations.

Continuous Learning: Stay updated with market trends and hone your skills through ongoing education. Attend seminars, read books, and learn from experienced traders to expand your knowledge base.

Journaling: Keep a trading journal to track your emotions, analyse your trades, and identify patterns of behaviour. This self-reflection can help you improve your decision-making process over time.

Take Breaks: Trading can be mentally taxing, so don’t hesitate to take regular breaks to recharge and regain perspective.

Mastering the psychology of trading is an ongoing journey for traders in Malaysia. By understanding how emotions influence decision-making and adopting disciplined risk management practices, you can tilt the odds of success in your favour. Remember, it’s not just about predicting market movements; it’s about mastering your own mind. So, stay focused, stay disciplined, and may your trades be ever profitable.