Ensuring financial security in your old age is a crucial aspect of long-term planning. As the workforce evolves and life expectancies increase, individuals and businesses alike are faced with the imperative task of securing stable financial futures. From diligent savings strategies to wise investment decisions, here’s a comprehensive guide on how to navigate the journey towards financial security in retirement.

Planning for Retirement: The Foundation of Financial Security

Planning for retirement should commence early in one’s career. The sooner individuals start saving and investing, the more time their assets have to grow. Establishing clear retirement goals is essential; it enables individuals to tailor their financial strategies accordingly. Assessing current financial standing and projecting future expenses can provide valuable insights into the amount needed to maintain a comfortable lifestyle during retirement.

The Importance of Diversification: Mitigating Risk

Diversification is a fundamental principle in investment management. Spreading investments across various asset classes helps mitigate risk and optimize returns. A well-diversified portfolio typically includes a mix of stocks, bonds, real estate, and other alternative investments. This approach can help safeguard against market volatility and economic downturns, ensuring a more stable financial outlook in old age.

Savings Strategies: Building a Financial Safety Net

Saving diligently is a cornerstone of financial security. Establishing an emergency fund to cover unforeseen expenses is essential, as it prevents individuals from dipping into retirement savings prematurely. Moreover, regular contributions to retirement accounts, such as 401(k)s and IRAs, enable individuals to benefit from compound interest and potential tax advantages over time.

Maximizing Retirement Accounts: Harnessing the Power of IRAs

Individual Retirement Accounts (IRAs) offer valuable tax benefits and flexibility in retirement planning. An IRA account allows for tax-deferred growth, meaning contributions are tax-deductible, and earnings accumulate tax-free until withdrawals are made in retirement. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement, making them an attractive option for individuals expecting to be in a higher tax bracket in the future.

Investing Wisely: Balancing Risk and Reward

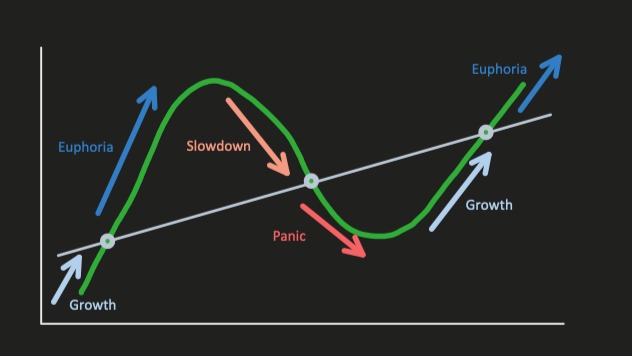

Investing wisely is essential for long-term financial security. While stocks offer higher potential returns, they also come with increased volatility. Bonds, on the other hand, provide stability but typically yield lower returns. Finding the right balance between risk and reward is crucial, as it ensures a sustainable income stream during retirement. Working with a financial advisor can help individuals tailor investment strategies to their risk tolerance and financial goals.

Continued Learning: Adapting to Changing Financial Landscapes

The financial landscape is constantly evolving, influenced by factors such as economic trends, regulatory changes, and technological advancements. Staying informed and continually educating oneself is key to navigating these changes effectively. Whether it’s attending seminars, reading financial literature, or consulting with professionals, ongoing learning empowers individuals to make informed decisions and adapt their financial strategies accordingly.

Estate Planning: Securing Legacies for Future Generations

Estate planning is an integral part of financial security in old age. By creating a comprehensive estate plan, individuals can ensure that their assets are distributed according to their wishes and minimize tax implications for their heirs. This may involve creating wills, establishing trusts, and designating beneficiaries for retirement accounts and life insurance policies. Proper estate planning not only provides peace of mind but also preserves legacies for future generations.

Embracing Lifestyle Changes: Adjusting Spending Habits

As individuals transition into retirement, adjusting spending habits becomes essential for maintaining financial security. Evaluating discretionary expenses and identifying areas where costs can be reduced can help stretch retirement savings further. Additionally, exploring supplemental income streams, such as part-time work or rental income, can provide additional financial support during retirement years.

Conclusion: Embracing Financial Preparedness for a Secure Future

In conclusion, ensuring financial security in old age requires careful planning, disciplined saving, and strategic investing. By diversifying investments, maximizing retirement accounts like IRAs, and staying informed about financial developments, individuals can navigate the journey towards retirement with confidence. Estate planning and lifestyle adjustments further contribute to a secure financial future, providing peace of mind and stability for oneself and future generations. Start preparing today to reap the benefits of financial security in your old age.