For many undergraduates and recent graduates, navigating the complex world of student loans is a critical step toward financial independence and stability. Proper management of these loans is essential not only for maintaining financial health but also for establishing a strong credit foundation and reducing financial stress. This article outlines the best practices for effectively managing student loans, offering a clear roadmap for staying on top of financial obligations and making the most of the opportunities they provide.

Understanding Your Student Loans

Comprehensive Overview:

The journey to successful loan management begins with a thorough understanding of your loan agreements. This includes familiarizing yourself with the interest rates, repayment schedules, total loan amounts, and the grace period before repayments start. Such knowledge empowers borrowers to make informed decisions and set realistic financial goals.

Diversity in Loan Options:

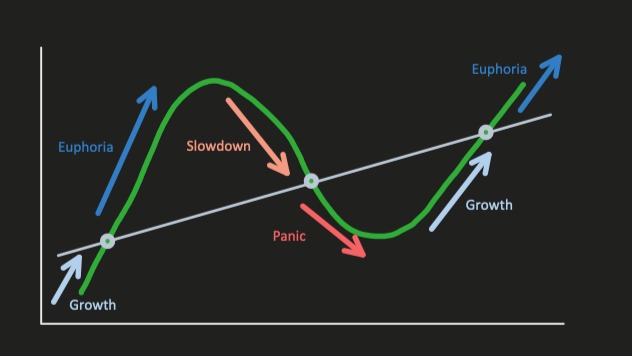

Student loans come in various forms, including federal and private options, each with unique terms and conditions. Federal loans are known for their lower interest rates and flexible income-driven repayment plans that adjust according to the borrower’s financial changes, providing a safety net during uncertain times. Private loans, while less flexible, can supplement where federal loans may not fully cover educational expenses.

Effective Repayment Strategies

Budgeting for Success:

Creating a detailed budget is crucial for effective debt management. Allocating funds specifically for debt repayment within your budget helps ensure consistent payments and prevents the risk of falling behind. This proactive approach to financial planning significantly enhances your ability to manage loans effectively.

Prioritizing Payments:

Adopting the debt avalanche method—prioritizing loans with the highest interest rates for additional payments—can drastically reduce the amount of interest paid over time. This method accelerates the repayment of more expensive debts, freeing up resources sooner for other financial needs or goals.

Exploring Consolidation and Refinancing:

Consolidating multiple federal student loans simplifies your finances by combining them into a single payment, potentially with a lower overall interest rate. Refinancing, although it involves careful consideration due to the potential loss of federal protections, can lead to lower payments and interest rates, making it a valuable option for those with stable financial situations.

Navigating Repayment Plans

Flexible Repayment Options:

Understanding the variety of available repayment plans can significantly reduce payment burdens. Plans such as Income-Driven Repayment (IDR) adjust monthly dues based on your income, which can be particularly beneficial for those in entry-level positions. Extended and Graduated Repayment Plans also offer lower initial payments, which gradually increase, aligning well with expected career salary growth.

Leveraging Forgiveness and Assistance Programs

Public Service Loan Forgiveness (PSLF):

For those in public service roles, PSLF remains a beacon of hope, offering loan forgiveness after 120 qualifying payments. This program not only encourages careers in public service but also provides substantial financial relief.

Employer Assistance Programs:

Increasingly, employers are recognizing the value of offering student loan repayment benefits. This support not only aids in the recruitment and retention of talented employees but also significantly reduces their debt burden and accelerates their financial independence.

Short Section on Undergraduate Student Loans

Maximizing the Value of Undergraduate Student Loans:

Undergraduate student loans are often the first significant financial commitment individuals undertake. These loans are crucial for covering tuition and essential college expenditures, setting the stage for future career and financial opportunities. By managing these loans wisely from the outset, students can establish solid financial habits that will benefit them throughout their lives.

Staying on Top of Payments

Automating Success:

Setting up automatic payments ensures that you never miss a payment deadline, which is crucial for maintaining an excellent credit score. Regular, on-time payments reflect positively on your credit report and can help build a strong financial reputation.

Proactive Communication:

Keeping in touch with your loan servicer, especially if you face financial hardships, can provide you access to deferment, forbearance, and alternative repayment options. These tools can be invaluable for staying on track during challenging times.

Regular Reviews:

Monitoring your loan status allows you to track your repayment progress and quickly address any discrepancies or issues. Regular reviews help keep you informed and engaged with your financial journey.

Conclusion

Effectively managing student loans is about leveraging them as tools for financial and personal growth. By understanding and strategically handling these financial commitments, borrowers can maximize the benefits of their educational investments. Remember, the objective is not just to manage but to master your student loans, paving the way toward financial freedom and enabling you to focus on future aspirations.