Buying property in Dubai has become increasingly popular among British investors and homebuyers. With zero income tax, strong rental yields, world-class infrastructure, and a growing real estate market, Dubai presents a compelling opportunity. But before you commit, understanding how to calculate your Dubai mortgage for UK residents is absolutely essential.

If you’re sitting in London, Manchester, Birmingham, or anywhere in the UK and wondering how to finance a property in Dubai, this comprehensive step-by-step guide will walk you through everything — from deposit requirements and eligibility criteria to interest rates and monthly repayment breakdowns.

Let’s dive in.

Why British Buyers Are Investing in Dubai Property

Dubai offers advantages that are difficult to match in the UK property market. High rental yields (often higher than many UK cities), no property tax, and strong capital appreciation make it appealing. Additionally, many UK residents see Dubai as a diversification strategy against economic uncertainty back home.

Another big draw? The UAE dirham is pegged to the US dollar, which adds a layer of currency stability. For British investors looking for international exposure, this is often seen as a strategic move.

But investment appeal aside, financing must be carefully calculated.

Can UK Residents Get a Mortgage in Dubai?

Yes, UK residents can apply for a Dubai mortgage for UK residents, even if they are non-residents of the UAE. Many UAE banks and international lenders offer mortgage products specifically tailored for foreign buyers.

However, the process differs slightly compared to getting a mortgage in the UK. Lenders will evaluate:

- Your income and employment stability

- Your credit profile

- Your debt-to-income ratio

- Your nationality and residency status

- The property type and developer

Being non-resident doesn’t prevent approval, but it does influence deposit requirements and interest rates.

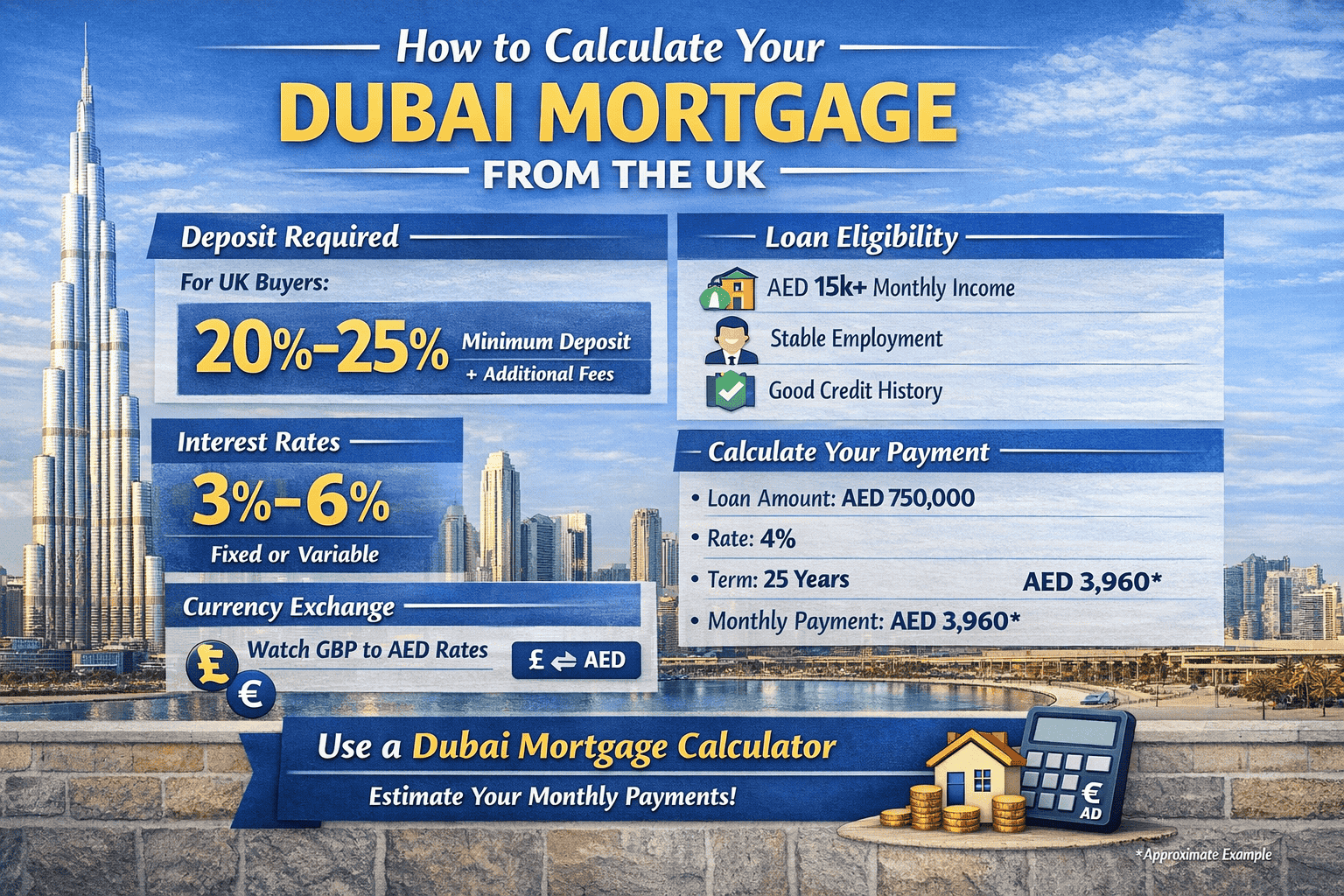

Step 1: Understand Deposit Requirements for UK Buyers

One of the first things you need to calculate is your deposit.

For non-residents (including most UK buyers):

- Minimum deposit is usually 20% to 25% of the property value.

- Some banks may require up to 40% depending on risk profile.

For example:

If you’re purchasing a Dubai property worth AED 1,000,000:

- 25% deposit = AED 250,000

- Mortgage amount = AED 750,000

Remember, this deposit does not include additional costs such as:

- Dubai Land Department (DLD) fees (4%)

- Mortgage registration fees

- Valuation fees

- Bank arrangement fees

You should budget an extra 6–8% of the property value for transaction costs.

Step 2: Check Dubai Home Loan Eligibility

Understanding Dubai home loan eligibility is crucial before applying.

Most lenders require:

- Minimum monthly income (often AED 15,000–25,000 equivalent)

- Stable employment (usually 6+ months in current job)

- Age between 21 and 65–70 at loan maturity

- Clean credit history

Banks will also assess your debt burden ratio (DBR). In the UAE, total monthly debt obligations should not exceed 50% of your income.

For example:

If you earn AED 40,000 per month, your total debt payments (including the Dubai mortgage) should not exceed AED 20,000.

UK credit reports may be reviewed, but UAE banks will primarily focus on income documentation, bank statements, and employment letters.

Step 3: Understand Interest Rates in Dubai

Interest rates in Dubai can be:

- Fixed rate (usually for 1–5 years)

- Variable rate (EIBOR + margin)

Rates typically range between 3% and 6%, depending on market conditions and borrower profile.

Here’s how this affects your calculations:

If you borrow AED 750,000 at 4% interest over 25 years:

Your monthly repayment will depend on amortization (which we’ll calculate below).

Keep in mind that fixed rates may switch to variable after the fixed term ends.

Step 4: Choose the Mortgage Term

Most Dubai mortgages are available for up to 25 years. However, the loan must be repaid before you turn 65–70 (depending on lender policy).

Longer term = Lower monthly payments

Shorter term = Higher monthly payments but less interest paid overall

Choosing the right tenure is key when calculating affordability.

Step 5: How to Calculate Your Monthly Dubai Mortgage Payment

Now let’s break it down practically.

Example Scenario:

Property Price: AED 1,000,000

Deposit (25%): AED 250,000

Loan Amount: AED 750,000

Interest Rate: 4%

Term: 25 years

Using standard amortization:

Monthly interest rate = 4% ÷ 12 = 0.333%

Number of payments = 25 × 12 = 300

Estimated monthly payment ≈ AED 3,960 – 4,000

Over 25 years, total repayment would be approximately AED 1.19 million, meaning around AED 440,000 in interest.

This is why understanding repayment structure is critical.

Step 6: Factor in Currency Exchange Considerations

As a UK resident earning in GBP, exchange rate fluctuations matter.

If GBP weakens against AED (pegged to USD), your mortgage effectively becomes more expensive. Conversely, if GBP strengthens, repayments feel lighter.

Some buyers hedge currency risk through:

- Forward contracts

- Currency exchange platforms

- Keeping income in USD-linked accounts

This is often overlooked but highly important in long-term calculations.

Step 7: Consider Rental Yield vs Mortgage Cost

If you’re buying as an investment, calculate:

Annual rental income ÷ Property price × 100

Dubai rental yields often range between 6%–8% in prime areas.

If your mortgage payment is AED 4,000 per month (AED 48,000 per year) and rental income is AED 70,000 per year:

You’re cash-flow positive before maintenance and service charges.

This makes Dubai attractive compared to many UK cities.

Step 8: Understand Additional Costs Beyond Mortgage

When calculating total affordability, include:

- Service charges (per sq. ft.)

- Maintenance

- Property management fees

- Insurance

- Life insurance (often mandatory)

Ignoring these can distort your financial planning.

Step 9: Pre-Approval Process for UK Residents

Before house hunting seriously, get a pre-approval from a UAE bank.

Documents typically required:

- Passport copy

- Proof of UK address

- 3–6 months bank statements

- Salary slips

- Employment letter

- Credit report

Pre-approval gives you clarity on how much you can borrow and strengthens negotiation power.

Step 10: Repayment Breakdown Explained Simply

Your mortgage payment consists of:

- Principal (reducing loan balance)

- Interest (bank’s charge)

In early years, most of your payment goes toward interest. Over time, more goes toward principal.

For example:

Year 1 monthly payment:

Interest portion: AED 2,500

Principal portion: AED 1,500

Year 15 monthly payment:

Interest portion: AED 1,200

Principal portion: AED 2,800

This is why early repayment decisions should be calculated carefully.

Fixed vs Variable Rate: Which Is Better?

Fixed rate offers stability and predictable budgeting. Variable rate may offer lower initial cost but can rise if market rates increase.

If you value certainty, fixed is safer. If you expect interest rates to fall, variable may be beneficial.

Your risk appetite should guide this choice.

Common Mistakes UK Buyers Make

Many British buyers underestimate:

- Total transaction costs

- Currency risk

- Service charges

- Early settlement fees

Another mistake is focusing only on property price rather than total ownership cost.

A clear mortgage calculation prevents financial stress later.

Using a Mortgage Calculator Dubai Buyers Trust

Instead of guessing, use a reliable Mortgage calculator Dubai tool to estimate:

- Monthly payments

- Total interest paid

- Loan affordability

- Different tenure comparisons

By adjusting loan amount, interest rate, and term, you can see realistic repayment scenarios before applying.

Use a Dubai mortgage calculator to estimate monthly payments before applying.

This simple step can save you from overcommitting financially.

Is Buying in Dubai Better Than the UK?

While the UK market offers stability, Dubai offers:

- No property tax

- No capital gains tax

- Higher rental yields

- Strong expat demand

However, each buyer’s situation differs. Always compare:

- Net returns

- Mortgage cost

- Market growth

- Currency exposure

Your financial goals should drive the decision.

Final Thoughts

Buying property in Dubai from the UK is entirely achievable — but only if you understand the financial structure behind it. Calculating your Dubai mortgage for UK residents involves more than just plugging numbers into a formula. You must consider deposit requirements, interest rates, eligibility criteria, exchange rates, rental yield, and long-term affordability.

By carefully evaluating Dubai home loan eligibility, comparing lender rates, and understanding repayment breakdowns, you can confidently move forward with your investment.

Before applying, always run your numbers through a trusted Mortgage calculator Dubai platform. It provides clarity, confidence, and smarter financial planning.

With proper preparation and accurate calculations, your Dubai property investment can become a powerful addition to your portfolio — whether for rental income, lifestyle, or long-term capital growth.